Abstract. This article analyzes the structure and dynamics of raw materials and commodities exports from the Siberian Federal District to the PRC. It focuses on the branch and geographic specificities of the foreign trade activity of individual parts of Siberia. Special attention is paid to the foreign trade policy of the PRC in the sphere of imports, particularly from Russian regions.

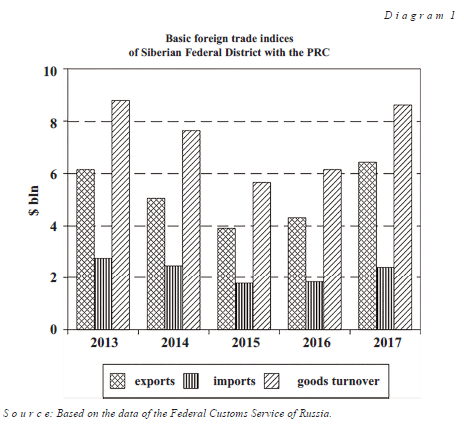

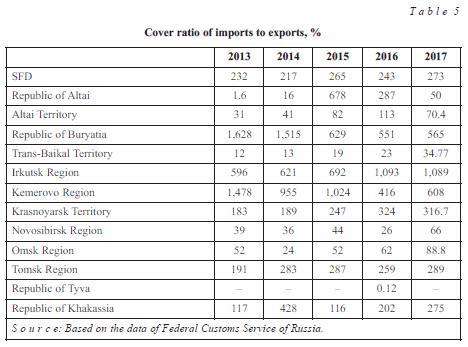

By the data of the Siberian Customs Department (further on SCD), in 2017 the Siberian regions supplied to the PRC fuel-and-energy, timber and ore resources, as well as food products to a sum of $6.24 billion, and imported Chinese products worth of $2 billion only, which was due to a favorable market situation and a lower rate of the ruble, which raised the competitive power of Russian commodities on the world market.1

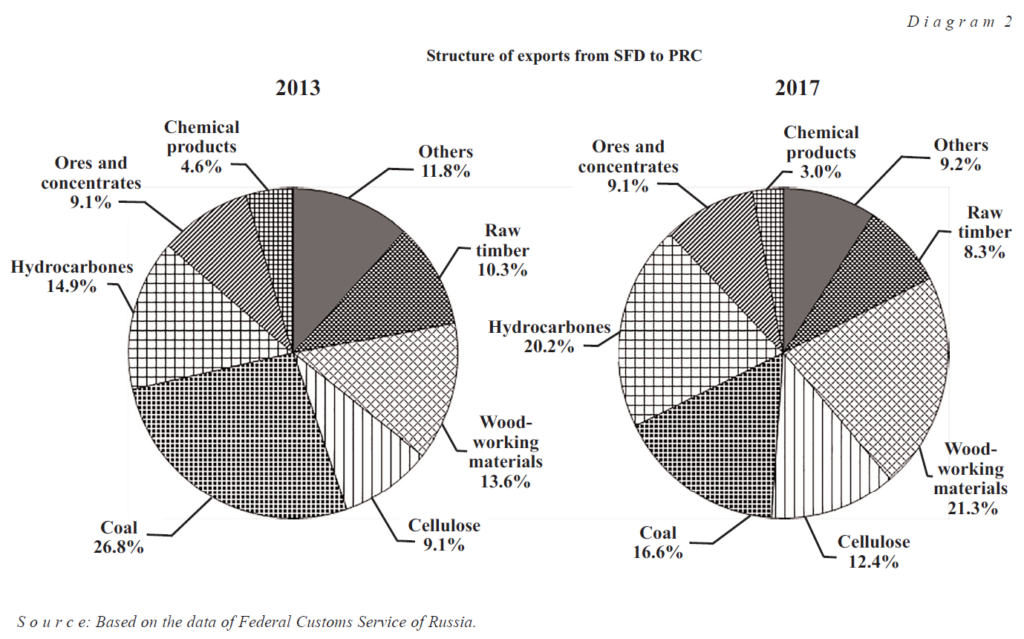

Siberian exports are known to be based on raw materials as the main products. The share of the timber, woodworking and cellulose-paper branches in the export of the Siberian Federal District (SFD) to the PRC grew from 2013 to 2017 by 10%, and the share of the fuel-and-energy products complex fell from 41.6% to 36%.

Let us look into the basic export items.

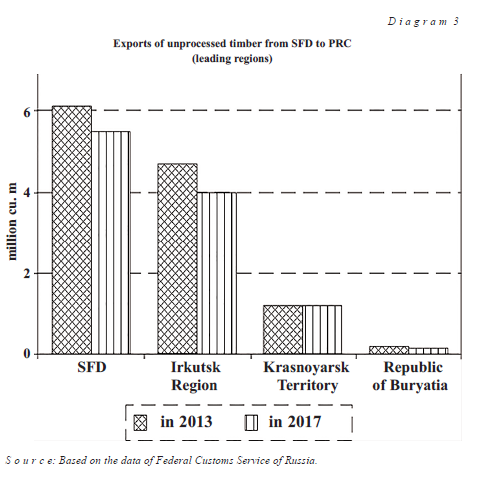

Raw timber and timber products of low processing are exported from Siberia to more than sixty countries of the world (90% of the cost of their volume are accounted for by the PRC, Japan, Egypt, and Central Asian countries). The latest trend is a lowering of physical volumes of the export

of round timber to the PRC along with growing volumes of coniferous saw log, which is connected with the decree of the Russian government of December 24, 2008 on increasing export customs duties by 25%.2

Raw timber is exported to the PRC from many parts of the Russian Far Eastern and Siberian Federal Districts. The leaders among them are Khabarovsk Territory (35% of the entire Russian exports to the PRC), Irkutsk Region (31%), Primorye Territory (13%), and Krasnoyarsk Territory (nine percent).3 Apart from that, timber is also largely exported from Tomsk Region and Altai Territory.4

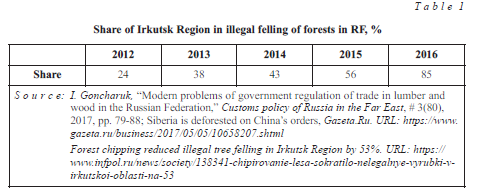

The export of round timber and lumber does not yield worthy incomes to the SFD, unfortunately, but creates problems, whose essence is well shown by Irkutsk Region. According to official data, in 2012, the legal procurement of liquid wood amounted to 25.1 million cu. m; in 2013 – 26.9 million; in 2014 – 29.2 million; in 2015 – 34.2 million;5 and in 2016 – 35.3 million cu. m of liquid wood.6 However, this is accompanied with a steady increase of illegal felling of round timber: in 2012 – 254,000 cu. m; in 2014 – 560,000 cu. m.7 In 2015, more than 17,000 cases of illegal felling of timber were revealed in Russia, with a total volume of 1.2 million cu. m. of wood: in Irkutsk region – 3,000 cases with 677,000 cu. m.8 It can well be asserted that a greater part of the illegally felled timber in the Siberian Federal District is supplied to the PRC.

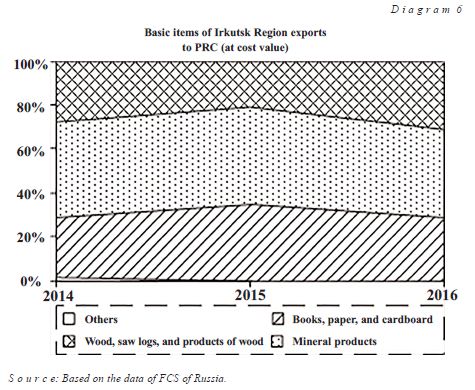

So, in Irkutsk Region, which boasts the greatest areas of taiga forests (83% of its entire territory) in the Russian Federation, timber procurement has become one of the most criminalized spheres of the economy. According to Table 1, from 2012 to 2016 the share of illegal timber felling in Irkutsk Region increased by 3.5 times.

Apart from the merciless annihilation of the taiga, there is a great threat to Lake Baikal. Timber felling in mountain conditions with the use of ordinary timber procurement and road machinery speeds up soil erosion. Deforestation near Baikal causes the ablation of clay, sand, and biogenic elements into the lake. 9

Due to specificity of its geographical position and the presence of the biggest RF-China border railway crossing Zabaikalsk-Manchouli, the Siberian Federal District is one of the leaders in the exports of round timber and the definite leader in the exports of saw logs (Table 2).

Although in recent years the exports of round timber diminished (it was partially replaced by saw logs), this does not solve the problem and does not promise an improvement of Siberian export, because saw logs is the product of the very low degree of processing (in 2016, difference in price of one cubic meter of unprocessed wood and saw logs comprised only $20-$25). Difference in price of unprocessed wood mass and saw logs is almost the same. (All the more so since sawing involves additional expenses.)

Why do Siberians continue to export timber to the PRC? First of all, because the domestic price of coniferous saw logs in Russia is about 1,450 rubles, and the export price ‒ $85 (that is, 3.5 times higher). Besides, transportation expenses within the Russian Federation are too high. Finally, timber felling, as it has already been noted, is partially a criminal business, especially in the Lake Baikal area, where it is controlled by Chinese groupings. As a result, in 2017, although supplies were exported to 55 countries of the world, 83% of the physical volume and 73% of the value volume of the SFD wood and saw logs exports were accounted for by the PRC.10

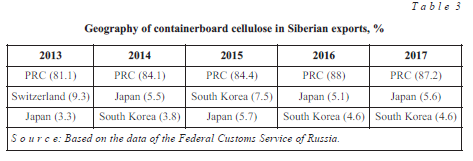

Ware cellulose, which is among the five most important export commodities of the timber-industrial complex of Russia, is the only product of processing with high value added. Our country supplies the world market with sulphate insolvable tree cellulose. Its main importer is China, and the chief Russian actor on the Chinese market is the Ilim Group. This company exports more than 40% of this product to China, including coniferous and foliose cellulose, as well as containerboard.11

In recent years, the physical volumes of Irkutsk Region cellulose exports to the PRC have been growing: in 2013, the figure was 979,000 tons, in 2017 – more than 1.4 million tons. However, the product gets to the Chinese market in the atmosphere of harsh competition.

- First, it is the pressure on the market on the part of the “eucalypt belt” countries – Brazil, Chile, and Uruguay.

- Second, demand for cellulose in the PRC is diminishing due to slower economic growth rates.

- Third, due to the creation of plantations of rapidly-growing transplants,12 its leading producer of paper and cardboard – APP-holding13 with the annual output at eight million tons can fully supply itself with its own raw material.14 True, Siberian cellulose has one serious advantage: coniferous cellulose is of greater density, paper from it is of a higher quality than of foliage origin.15

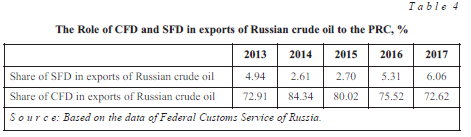

Products of the fuel-and-energy complex (FEC). Their share in Russian

exports is from 57% to 77%, which is largely due to Krasnoyarsk oil. However, if we look into customs statistics, in the period between 2013 and 2017, Krasnoyarsk Territory did not export crude oil to the PRC at all. This can be explained by the fact that Siberian oil is exported to China from Taishet (Irkutsk Region) by the Central Federal District (CFD) whose offices are in Moscow. Strange as it would seem, during the 12 months of 2017 Moscow shipped 37,479,000 tons of oil to China.

True, irrespective of the cunning of figures it is a fact that from 2005 to 2016 Rosneft supplied China with 195.5 million tons of oil to a total of $98.6 billion.16 Considerable part of the oil extracted and exported by Rosneft to China is extracted in the country’s East, including in Siberia.

Coal, along with timber products, is a traditional item of Siberian exports. Kemerovo Region and Republic of Buryatia account for more than 70% of its export to China. Beginning from 2011, the price of coal on the world market has been going down. The cost of a ton of coal in Far Eastern ports was $35, which, compared with competitors supplying coal from Australia to China, or Brazil to China is too expensive ($9 and $22 per ton).17

In 2016, the situation began to change: in the second half of the year, prices of coal doubled reaching $100 per ton in November. In 2017, politics meddled with the export of coal: from February onward, China stopped purchases of anthracite in North Korea due to the sanctions introduced by the UN Security Council, and it had to increase its import from Russia (already in the first six months of 2017 the figure grew threefold as compared with the same period of 2016).18 The biggest supplies were shipped from Novosibirsk Region (in 2017, more than 3.5 million tons, or 3.2 times more than in 2016), and also from the Kuzbass coal deposits.

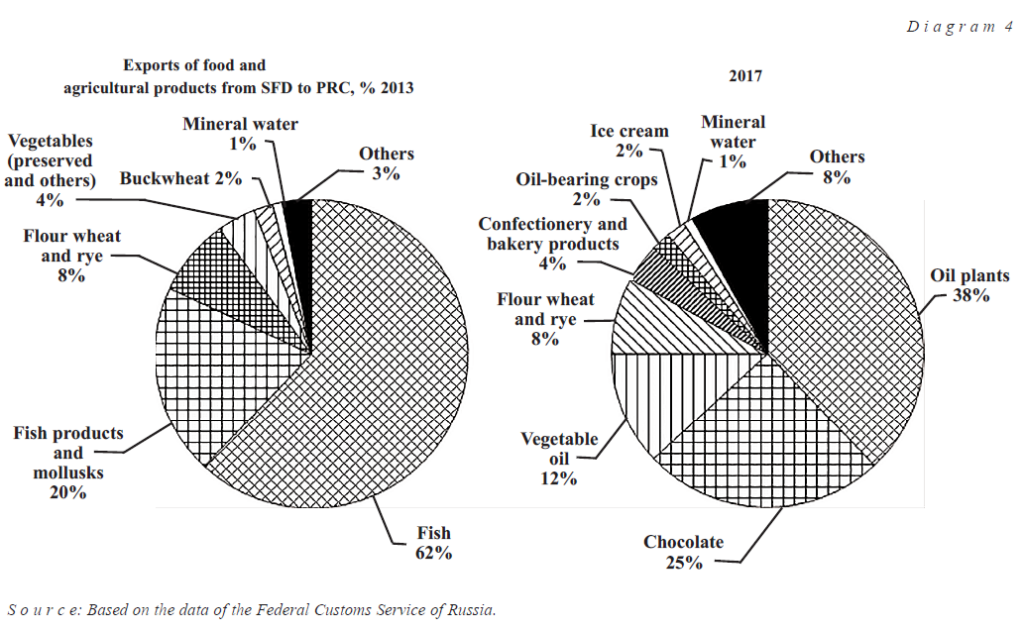

Food products is a new item which appeared in Russian-Chinese trade in 2014. Due to a marked decrease of the purchasing power of the Russian population, Siberian producers became more active in exporting confectionery to foreign markets. Kemerovo and Omsk regions became the main Siberian exporters of these products to the PRC (they were ahead of Moscow Region and Moscow).

Numerous Chinese trade networks show interest in the import of food products from the Russian Federation, which are considered ecologically pure and popular among Chinese customers. Incidentally, surcharge and mark-up in trade networks on certain types of Russian products may considerably differ from supplier’s prices. For instance, surcharge on vegetable oil varies within the limits of 15%-30%, and on confectionery the price on the counter and the export price of the factory may differ 30-fold.19

True, it is too early to think that Siberian food products have succeeded to win the Chinese market. Siberian food companies begin to come across not only problems of competition, but also structural difficulties in their branch. The moral and physical depreciation of the basic assets of a number of our food companies decreases the opportunities of expansion and change of assortments, raises expenses, and stems the growth of production volumes. Apart from that, Siberian food companies still depend too much on imported raw materials and semifinished products, as well as on technologies and equipment. This dependence is so strong that they are unable to commission production capacities all at once fully, or create new technological lines for turning out products.20 The problem of availability and deadline has become a stumbling block for Siberian producers. As it has already been noticed time and again in China, Russian food products are regarded there as ecologically clean with a minimal presence of additives. Quite a few products have the availability deadline from three to six months, which is unacceptable for Chinese importers, who demand the period of up to a year. That is, a given product becomes included in another quality category, because it will be necessary to increase the share of additives. The financial problem is not simple for our regional producers wishing to enter the Chinese market. According to experts’ estimates, the minimal investments for an independent entry into the Chinese market comprise one million dollars.21

The only food product exported from Siberia and some other regions of Russia very successfully is vegetable oil. The most favorable time was December 2015 and April 2016, when 6.4 and 6.8 thousand tons were supplied to China. All in all, 95 thousand tons were exported to a sum of $80 million from the beginning of 2013 to December 2017. Mainly colza oil (49%) and sunflower oil (41%) were exported. The PRC, therefore, was the leading importer of Siberian vegetable oil in that period.

In the exports of colza oil to China Siberia is the indisputable leader in Russia, but as far as sunflower oil is concerned, Siberia has a serious competitor in the person of the Volga Federal District. Export of oil to China from there comprised $183 million during the same period and amounted to total weight – 219,000 tons.22 Sunflower oil was the only oil imported.

Exports of agricultural products is a more complex business than that of

food products. Inasmuch as in recent years Russia has become the world leader in exports of wheat, agricultural workers of Siberia and other regions have become obsessed with the desire to export it to the PRC, but the demands of the Chinese side to the import of grain are extremely strict: they include sanitary control of wheat seeds.23 Other demands include strict control of soil and grain storage premises and equipment of bakeries, sanitary inspection of grain consignments prepared for shipment to the PRC. The Chinese quarantine service demands that grain transportation to China should be made only in sacks 50 kilos each, loaded onto covered railway cars. One of the reasons is the difference in railway gauge width, which makes it incumbent to reload the cargo on the border post. To pack thousands of tons of grain into comparatively small sacks means to organize a large-scale packing facilities for production of industrial capacities.24

Due to all these circumstances, it is only four entities of the Siberian Federal District which have the right to export spring wheat to China, namely, Altai and Krasnoyarsk territories and Novosibirsk and Omsk regions. This decision was taken in December 2015, but its results are meager. The process of negotiating and agreeing on the volumes of deliveries is still far from the desired results.

For example, Novosibirsk Region has agreed with the Chinese COFCO

Group25 on the volume of deliveries amounting to 24,000 tons in 2017, but from January to December it was able to supply only three sample consignments with a total tonnage of 5,000.26 This is due to the fact that the Chinese government accepts a decision annually on the grain import quotas and negotiations of an agreement may last for years. Customs duty on the import quotas of grain is one percent, and that imported out of quota may be 65%.27 Ninety percent of the grain import quota volume to the PRC are received by the COFCO Company,28 and the remaining 10% are distributed among private companies of China.29 It is inconvenient for the COFCO Group to work with individual Russian entities, but we do not have a similar trading organization.

According to the Committee Chairman of the Legislative Assembly of Novosibirsk Region on agrarian policy, natural resources, and land relations, Oleg Podoima, of the nine demands presented by the Chinese side to us we have been able to fulfill only one so far. Confirmation of this is a considerable curtailment of grain deliveries to China from the main Siberian granary – Altai Territory. In contrast to other parts of the Siberian Federal District, where the basis of their export to China is timber, coal, ores, metal, and rubber, it is only the Altai Territory that supplies it with agro-industrial and food products (linseed, wheat, vegetable oils, and flour). During preceding two years, the territory constantly increased their deliveries, but in 2017, it drastically (by 40%) cut the volume of exports.30

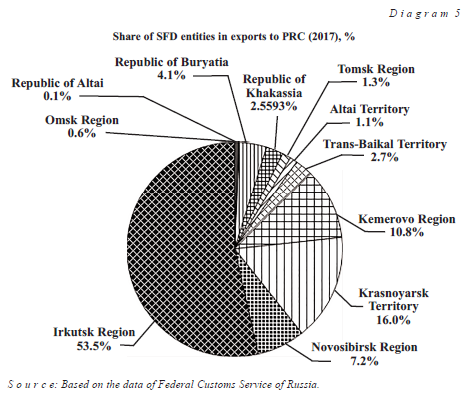

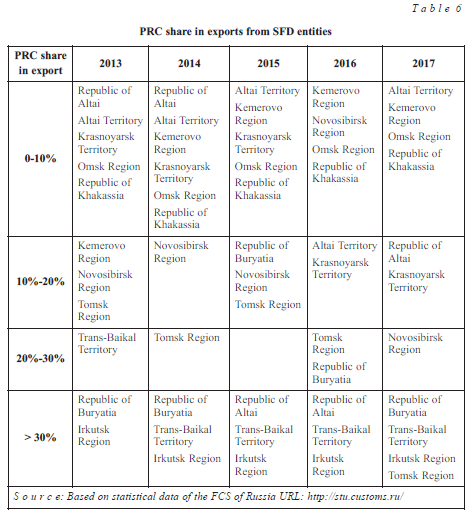

Let us dwell on the intraregional specificities of the exports of Siberian regions to the PRC. Historically, the trade profit of the SFD with the PRC takes shape mainly due to the active exports by three actors.

From 2015, the number of regions with a positive trade balance with China increased from five to seven. Four subjects have a stable deficit, and one entity of the SFD – Republic of Tyva – does not have trade relations with the PRC at all.

China is the biggest foreign-trade partner of the Trans-Baikal Territory and above all, the entire Irkutsk Region. The level of foreign-trade turnover between them is quite high, although it has fallen down after the start of a crisis. As we have already noted, round timber and saw logs are regularly shipped to China, just as cellulose, oil, and oil products. In a short while, there will be gas supplies from East Siberian deposits along the Sila Sibiri gas pipeline now under construction.

Krasnoyarsk Territory took 2nd place in volumes of export after Irkutsk

Region in 2017 (goods worth of $985 million). With a positive balance of

$674 million, the PRC holds second place in goods turnover and exports of commodities from the territory and first place in supplies to Krasnoyarsk Territory. Among the items exported to China are coniferous saw log, tin and zinc ores, round timber, as well as building materials.31 Krasnoyarsk Territory is Russia’s leader in the exports of lead ores (including to China), which is connected with the Vorogovsko-Angarsk zone concentrating almost 40% of Russian resources of lead, on the whole, in the Gorevsky deposit.32

The three foremost exporters also include Kemerovo Region whose exports to China increased in 2017 by 1.6 times, having topped the figure of $600 million. This result was mainly due to an increase of the export cost of Kuzbass coal.33 In the period between 2015 and 2017, the annual exports of Kuzbass coal to the PRC reached about five million tons, but the price of a ton at the time noticeably fluctuated. Beginning from 2011, the price on the world market fell down from $140 to $53 per ton at the end of 2016. In such situation, the Kuzbass was not anxious to increase exports of its coal not only to China, but also to other foreign markets. In the summer of 2016, the situation with Kuzbass coal changed for the better, which was connected with natural cataclysms in China and Australia, and also with a curtailment of the number of workdays of Chinese miners from 330 to 276.34 As a result, in 2017 prices of coal crossed the $100 mark.

Among the outsiders in trade turnover with China are Omsk Region, the

Republic of Khakassia, and the Republic of Tyva.

On the basis of the data cited in Table 6 another entity of the SFD should be singled out for which trade with the PRC is “vitally important – this is Trans-Baikal Territory whose import by 95%-97% comes from its southern neighbor, and export diversification has changed for the worse in the past two to three years. In 2013, only 22%-25% of its export was going to China, whereas in 2017 the figure was over 62%. Such dependence on only one partner with a weakly developed economy may be fraught with many serious problems. However, this does not seem to seriously worry the heads of the Trans-Baikal Territory. In an interview to the Xinhua News Agency, the Governor of the Territory, N. Zhdanova noted that “China has been and remains the biggest trade partner of the Trans-Baikal Territory. At present, a whole number of major strategic projects in such spheres as investments, timber processing, tourism, and transportation infrastructure are under way.”35 There is no doubt that such cooperation is extremely advantageous to the PRC. In the commodity structure of the export of the Trans-Baikal Territory the main positions are taken by products of the initial processing, above all tungsten, lead, copper concentrates, ferromolybdenum, and coal. Practically the entire ferromolybdenum produced in the territory is used for the production of high-quality steel and is exported. Such situation is explained by the practical absence of the domestic demand not only in the territory, but in the Russian Federation.36

Although the biggest Russia-China border crossing is situated in Trans-Baikal Territory, its socioeconomic life in the region does not improve, despite the fact that the crossing has set certain “records” in 2017. For example, exports of liquid wood in 2017 reached its historical maximum – 11,841 million cu. m. In all, 157,000 consignments of timber were shipped to China via this crossing in 2017.37 Imports of coal from Russia last year amounted to 2,806 million tons, which was 7.4 times more than in the preceding year.38 Chinese customs officials in Manzhouli point to another “record”: in 2017, more sawn timber, unprocessed wood, lead, and dressed ore worth of $2.1 billion, or more than by 56.8% than the year before, were shipped via that crossing.39 During the past thirty years, Manzhouli has turned into a real modern city, and town of Zabaikalsk has decayed. We think that such trend will continue even if Trans-Baikal Territory gets into the sphere of action of the Silk Road Economic Belt and the Maritime Silk Road of Heilongjiang province program.”40

The Altai Territory has become another entity of the SFD interesting for

examination. In 2013, China accounted for only less than five percent in its exports, whereas in 2016, the figure reached 15% (although in 2017 it again dropped down to less than 10 percent). This territory has a considerable potential in export supplies of agrarian and food products and is a favorable district concerning food supplies of its population. The territory can deliver to foreign markets a broad variety of food products. By the results of the first six months of 2017, Altai enterprises maintain the leading positions in the country in the output of flour, cheese, butter, cornflakes, biological food additives. By turning out grits Altai Territory is in second place in Russia (in buckwheat and oats in first, and in macaroni and pasta – in third place). It is the only region in Siberia and the Far East where granulated sugar is made of sugar beet.41

Beginning from 2013, Altai Territory has been increasing exports of food

and agricultural products to the PRC. In 2013, it was only individual products (for example, wheat and rye flour). Then, by the end of 2013, preserved vegetables were added to the list of exported products. Beginning from the end of 2014, exports of vegetable oil (above all, colza oil) to China has grown sharply. From June 2014 to December 2017, the territory exported to the PRC 64.1 thousand tons of vegetable oil, or 68% of the entire Siberian exports of this product. In 2013-2014, the share of food and agricultural products in the export of Altai Territory to the PRC amounted to about 11%-13%, in 2015, the figure rose to 41%, the share of vegetable oil alone was more than 29%. In 2016, the maximum figure was reached, that is, when the share of food and agricultural products accounted to 63% of the total exports of the territory to the PRC. The assortment of the goods exported was quite broad – right up to frozen fish from Siberian rivers, medicinal plants, and ice cream.

The territory holds the leading position in the SFD export to the PRC on the following items: sunflower oil over 86%, flax seeds – 70%, colza oil – 62%, ice cream – 44%, wheat and rye flour – 32%. The territory has a unique situation: practically 39% of export to the PRC is accounted for by food and agricultural products.

In conclusion, we would like to note that in the next few years there will

hardly be any radical improvement of the structure of Siberian exports to China.

- First, after the commissioning of the Sila Sibiri gas pipeline, supplies of Russian raw materials will be increased.

- Second, as has already been noted, there is no serious regional and federal program of promoting Russian highly-processed export commodities to China. The Russian Export Center is not able to cope with this task, inasmuch as there is only one expert on China on its staff. The branch structures in our country are incapable to join producers, who quite often compete with one another.

- Third, what’s more, the PRC does not seem to be interested in Russia as a country exporting high-tech and highly-processed products.

NOTES:

- T. Kuznetsova, “Having Conquered the Celestial Empire. Siberia Exports to China More than Buys from It,” Rossiyskaya gazeta. Special issue # 7454 (289). URL: https://www.rg.ru/2017/12/21/reg-sibfo/eksport-iz-sibiri-v-kitai-prevysil-import-v-25-raza.html

- Decree of the RF Government # 982 of December 24, 2008, Rates of export customs duties on certain types of timber material exported from the Russian Federation beyond boundaries of states members of the Customs Union agreement.

- Calculated on the basis of the data of the Federal Customs Service of Russia. URL: http://www.customs.ru

- Siberian Customs Department / Customs statistics of foreign trade. Foreign Trade. URL: http://stu.customs.ru

- On the most acute timber problems of Irkutsk Region. URL: https://ecodelo.org/rossiyskaya_federaciya/sibirskiy_fo/irkutskaya_oblast/40570-o_samyh_ostryh_lesnyh_problemah

- Government report On the Condition and Protection of Environment in Irkutsk Region in 2016. URL: http://irkobl.ru/sites/ecology/%D0%BC%D0%/B0%DA%D0%B5%D1%82.pdf

- Unprecedented felling of Irkutsk taiga brings benefit only to China. URL: http://activatica.org/problems/view/id/563/version/930

- Illegal deforestation in Irkutsk Region is observed from outer space. URL: http://www.rosleshoz.gov.ru/media/news/3312

- Ekolog: felling the burnt forest around Lake Baikal is more harmful than helpful. URL: http://nsn.fm/regions-of-russia/ekolog-ot-vyrubki-gorelogo-lesa-vokrug-baikala-bolshe-vredachem-polzy.html

- Export of timber materials from Siberian regions grew almost by one-quarter in 2017. URL: https://ksonline.ru/304310/eksport-lesomaterialov-2/

- K. Kurkin, Prizrak pereproizvodstva [Spectre of Overproduction]. URL: http://expert.ru/northwest/2017/23/prizrak-pereproizvodstva/

- Prospects of Russia on the world market of cellulose. URL: https://programlesprom.ru/perspektivy-rossii-na-mirovom-rynke-cellyulozy

- AsiaPulpPaper – one of the world leaders of paper industry. Concern of several plants on the territory of China and Indonesia.

- China increases import of Russian cellulose. URL: http://www.lesonline.ru/news/?id-277758

- Sulphate cellulose obtained from foliose wood differs from cellulose obtained from coniferous wood. It contains less xylogen. The breaking length of birch cellulose is somewhat less than that of pine cellulose. This index of asp cellulose is by 1,500-2,000 m less than that of pine cellulose and amounts to 1,500-2,500 double kinks. Resistance to laceration is lower by 20% to 25% than the similar index of pine cellulose (for more details see: output-input ratio of the

- green leaf, vitamins in plants. URL: http://lsdinfo.org/pererabotka-listvennoj-i-melkotovarnojdrevesiny/

- A. Gromov and A. Titov, “Rosneftyanoye” uskoreniye rossiysko-kitaiskogo energeticheskogo sotrudnichestva [“Rosneftyanoye” Speed-up of Russian-Chinese Energy Cooperation]. URL: https://fief.ru/upload gromov_titov_neft&capital.pdf

- Russian and international coal market. URL: http://www.e-rej.ru/upload/iblock/a75/a75ad208830190f10f7e7bdc/7987b0f4.pdf

- Import of anthracite coal from Russia to China has grown threefold. URL: http://www.sibanthracite.ru/media/2017/08/16//import-anthracita-iz-rossii-v-kitaj-vyros-vtroe/

- O. Pavlova, Potyanulo v Kitai [Drawn to China]. URL: www.kommersant.ru/doc/3220328

- Effect of sanctions coming to an end. URL: http://expert.ru/siberia/2017/46/effekt-ot-sanktsij-na-ishode/

- O. Pavlova, Op. cit.

- Siberian Customs Department // Customs statistics of foreign trade. Foreign trade. URL: http://stu.customs.ru/

- First consignment of wheat from Kransnoyarsk Territory to China, Site of the Federal Service on Veterinary and Plant Control. URL: http://www.fsvps.ru/fsvps/news/20535.html

- A. Kovalenok, Will grain deliveries to China solve problems facing Novosibirsk agrarian workers? URL: https://nsk.rbc.ru/nsk/23/11/2017/5a1552d69a794717549eed24

- COFCO was founded in 1949, it is on the list of 500 biggest companies of the world and stands at the head of top-100 food enterprises of China. The cost of its assets is estimated at $71.9 billion, it has 336 branches and affiliations in 140 countries. Its storage capacities exceed 31 million tons and processing capacities – 89.5 million tons.

- A. Kovalenok, Op. cit.

- In 2016, China will have the import quotas of grain unchanged. URL: https:www.apk-inform.com/ru/news/1052286

- COFCO Corporation set up in 1949 is a versatile government organization engaged in purchases, trading, as well as deep processing of grain.

- Information on the exports of Kazakhstan products to China / National Chamber of Entrepreneurs RK “Atameken.” URL: http://atameken.kz/ru/pages/649-informaciya-po-eksportukazahstanskoj-produkcii-v-knr

- T. Kuznetsova, Op. cit.

- China remains the main importer of goods to Kransnoyarsk Territory. URL: http://zapad24.ru/news/krasnoyarsk/56551-kitay-ostaetsya-glavnym-importerom-tovarov-v-krasnoyarskiykray/html

- The use of Russian lead. URL: https://studwood.ru/1230186/geografiya/sostoyanie_ispolzovanie_svintsa

- T. Kuznetsova, Op. cit.

- Turn to coal. URL: https://ksonline.ru/259965/ugolnyj-povorot/

- Natalia Zhdanova has told Xinhua News Agency about cooperation between Trans-Baikal Region and China. URL: https://zab.ru/news/100943_natalya_zhdanova_rasskazala_ia_sinhua_o_sotrudnichestve_zabajkalya_i_kitaya

- I. Zabelina and Ye. Klevakina, Osobennosti torgovo-ekonomicheskogo sotrudnichestva mezhdu Zabaikalskim krayem i provintsiyami Kitaiskoy Narodnoy Respubliki [Specific Features of Trade and Economic Cooperation between Trans-Baikal Territory and Provinces of the People’s Republic of China], Notes of Trans-Baikal branch of the Russian Geographical Society.

- Issue 135: Geographic research in border periphery districts in market conditions / Trans-Baikal State University, Chita, 2016, pp. 206-213.

- Historical record of timber export to the PRC through Trans-Baikal Territory has been topped. URL: https://zab.ru/news/102546_pobit_istoricheskij_rekord_eksporta_lesa_v_knr_cherez_zabajkale

- In 2017, imports of coal via Manchuria exceeded 2.8 million tons. URL: http://biang.ru/ru/economics/v-2017-godu-import-uglya-cherez-manchzhuriyu-prevysil-2,8-mln-tonn.html

- In 2017, the commodity turnover of Manchurian Customs with the Russian Federation grew by 19.8%. URL: http://biang.ru/ru/news/v-2017-godu-tovarooborot-tamozhni-mnchzhurii-s-rf-vyros-na-19,8.html

- I. Stavrov, Ekonomicheskiy koridor Kitai – Mongolia – Rossiya v strategiyi sotsialno-ekonomicheskogo razvitiya provintsiyi Heiluntsian [Economic Corridor China – Mongolia – Russia in Strategy of Socioeconomic Development of Heilongjiang Province], Customs Policy of Russia in the Far East, # 2, 2017, pp. 39-50.

- Analytical information on development of branches / Department of Altai Territory on food, processing, pharmaceutical industry, and biotechnologies.

Translated by Yevgeny Khazanov